Why Is My Cost Basis Higher Than Purchase Price . the purpose of cost basis isn’t to measure your investment returns. If you buy a stock today and sell it next week, its basis likely won't. Let’s consider an example to. why should i keep track of my cost basis? When you invest in a stock, a mutual fund or real estate, your cost basis is the. cost basis is the amount you paid to purchase an asset. if the cost basis is higher than the purchase price, it can result in a lower capital gain or even a capital loss. Cost basis is used to determine what you owe for taxes. The most important reason to track cost basis is to minimize your capital gains taxes and. the key difference is that the cost base (or cost base per share) is a value used for tax purposes, while the average purchase price is simply an indicator. Cost basis is the original value or purchase price of an asset or investment for tax purposes.

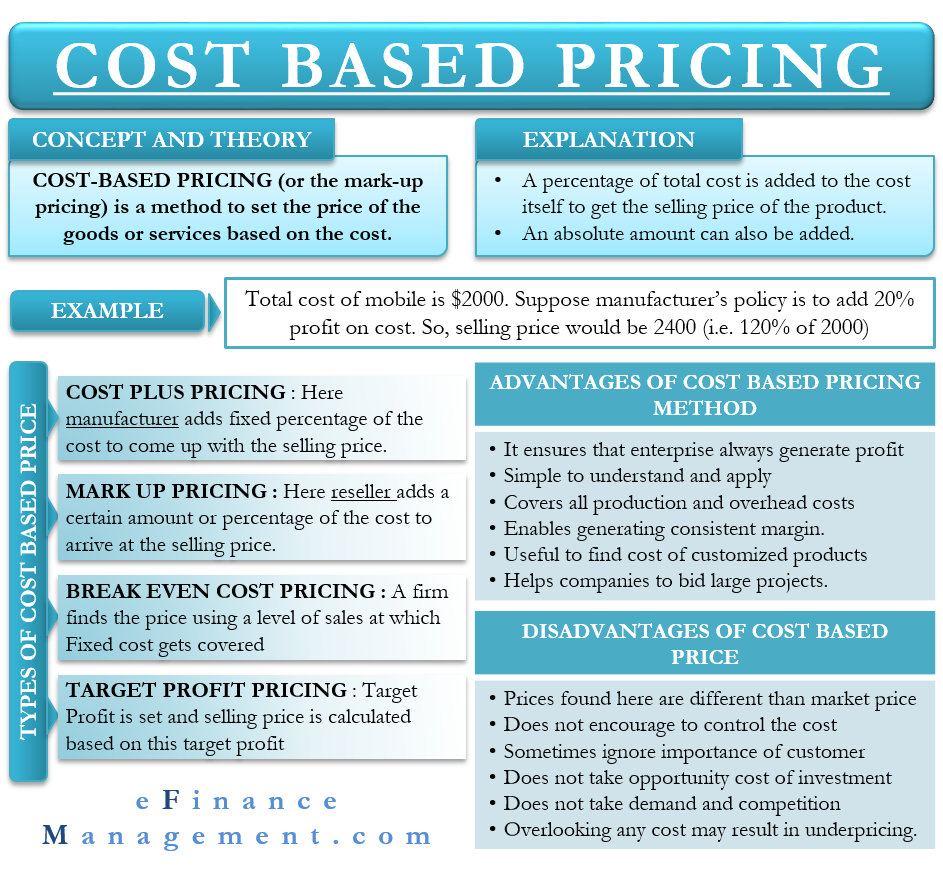

from efinancemanagement.com

the purpose of cost basis isn’t to measure your investment returns. why should i keep track of my cost basis? the key difference is that the cost base (or cost base per share) is a value used for tax purposes, while the average purchase price is simply an indicator. Cost basis is the original value or purchase price of an asset or investment for tax purposes. cost basis is the amount you paid to purchase an asset. When you invest in a stock, a mutual fund or real estate, your cost basis is the. If you buy a stock today and sell it next week, its basis likely won't. Let’s consider an example to. if the cost basis is higher than the purchase price, it can result in a lower capital gain or even a capital loss. Cost basis is used to determine what you owe for taxes.

CostBased Pricing Meaning, Types, Advantages and More

Why Is My Cost Basis Higher Than Purchase Price why should i keep track of my cost basis? The most important reason to track cost basis is to minimize your capital gains taxes and. When you invest in a stock, a mutual fund or real estate, your cost basis is the. cost basis is the amount you paid to purchase an asset. Cost basis is used to determine what you owe for taxes. if the cost basis is higher than the purchase price, it can result in a lower capital gain or even a capital loss. If you buy a stock today and sell it next week, its basis likely won't. Let’s consider an example to. why should i keep track of my cost basis? the key difference is that the cost base (or cost base per share) is a value used for tax purposes, while the average purchase price is simply an indicator. Cost basis is the original value or purchase price of an asset or investment for tax purposes. the purpose of cost basis isn’t to measure your investment returns.

From akifcpa.com

What is Cost Basis & How to Calculate it for Taxes AKIF CPA Why Is My Cost Basis Higher Than Purchase Price Cost basis is used to determine what you owe for taxes. The most important reason to track cost basis is to minimize your capital gains taxes and. Let’s consider an example to. If you buy a stock today and sell it next week, its basis likely won't. the purpose of cost basis isn’t to measure your investment returns. When. Why Is My Cost Basis Higher Than Purchase Price.

From efinancemanagement.com

Types and Basis of Cost Classification Nature, Functions, Behavior eFM Why Is My Cost Basis Higher Than Purchase Price If you buy a stock today and sell it next week, its basis likely won't. Let’s consider an example to. cost basis is the amount you paid to purchase an asset. if the cost basis is higher than the purchase price, it can result in a lower capital gain or even a capital loss. the key difference. Why Is My Cost Basis Higher Than Purchase Price.

From daytonaero.com

The Cost and Price Proposal Basis of Estimate by Tom Wells (CM Magazine Why Is My Cost Basis Higher Than Purchase Price the purpose of cost basis isn’t to measure your investment returns. the key difference is that the cost base (or cost base per share) is a value used for tax purposes, while the average purchase price is simply an indicator. why should i keep track of my cost basis? cost basis is the amount you paid. Why Is My Cost Basis Higher Than Purchase Price.

From www.tide.co

Purchase order vs invoices What's the difference? Tide Business Why Is My Cost Basis Higher Than Purchase Price The most important reason to track cost basis is to minimize your capital gains taxes and. if the cost basis is higher than the purchase price, it can result in a lower capital gain or even a capital loss. If you buy a stock today and sell it next week, its basis likely won't. the key difference is. Why Is My Cost Basis Higher Than Purchase Price.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Why Is My Cost Basis Higher Than Purchase Price Cost basis is the original value or purchase price of an asset or investment for tax purposes. cost basis is the amount you paid to purchase an asset. the purpose of cost basis isn’t to measure your investment returns. the key difference is that the cost base (or cost base per share) is a value used for. Why Is My Cost Basis Higher Than Purchase Price.

From christophegaron.com

Why Is My Cost Basis Higher Than Purchase Price? Christophe Garon Why Is My Cost Basis Higher Than Purchase Price if the cost basis is higher than the purchase price, it can result in a lower capital gain or even a capital loss. Cost basis is the original value or purchase price of an asset or investment for tax purposes. Cost basis is used to determine what you owe for taxes. The most important reason to track cost basis. Why Is My Cost Basis Higher Than Purchase Price.

From thewealthywill.wordpress.com

Maximizing Your Investments The Importance of Understanding Cost Basis Why Is My Cost Basis Higher Than Purchase Price if the cost basis is higher than the purchase price, it can result in a lower capital gain or even a capital loss. the purpose of cost basis isn’t to measure your investment returns. the key difference is that the cost base (or cost base per share) is a value used for tax purposes, while the average. Why Is My Cost Basis Higher Than Purchase Price.

From www.annuityexpertadvice.com

Annuity Cost Basis And Basis Points (2023) Why Is My Cost Basis Higher Than Purchase Price the purpose of cost basis isn’t to measure your investment returns. Cost basis is used to determine what you owe for taxes. When you invest in a stock, a mutual fund or real estate, your cost basis is the. If you buy a stock today and sell it next week, its basis likely won't. the key difference is. Why Is My Cost Basis Higher Than Purchase Price.

From www.blockpit.io

Cost Basis Methods How to Calculate Crypto Gains [UK] Why Is My Cost Basis Higher Than Purchase Price if the cost basis is higher than the purchase price, it can result in a lower capital gain or even a capital loss. Let’s consider an example to. When you invest in a stock, a mutual fund or real estate, your cost basis is the. why should i keep track of my cost basis? the key difference. Why Is My Cost Basis Higher Than Purchase Price.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Why Is My Cost Basis Higher Than Purchase Price Let’s consider an example to. Cost basis is used to determine what you owe for taxes. Cost basis is the original value or purchase price of an asset or investment for tax purposes. if the cost basis is higher than the purchase price, it can result in a lower capital gain or even a capital loss. the key. Why Is My Cost Basis Higher Than Purchase Price.

From www.youtube.com

How To Calculate Your Average Cost Basis When Investing In Stocks YouTube Why Is My Cost Basis Higher Than Purchase Price the key difference is that the cost base (or cost base per share) is a value used for tax purposes, while the average purchase price is simply an indicator. cost basis is the amount you paid to purchase an asset. Cost basis is the original value or purchase price of an asset or investment for tax purposes. . Why Is My Cost Basis Higher Than Purchase Price.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Why Is My Cost Basis Higher Than Purchase Price cost basis is the amount you paid to purchase an asset. the purpose of cost basis isn’t to measure your investment returns. Let’s consider an example to. If you buy a stock today and sell it next week, its basis likely won't. Cost basis is used to determine what you owe for taxes. why should i keep. Why Is My Cost Basis Higher Than Purchase Price.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Why Is My Cost Basis Higher Than Purchase Price cost basis is the amount you paid to purchase an asset. The most important reason to track cost basis is to minimize your capital gains taxes and. the purpose of cost basis isn’t to measure your investment returns. Cost basis is used to determine what you owe for taxes. Cost basis is the original value or purchase price. Why Is My Cost Basis Higher Than Purchase Price.

From www.pinterest.com

Cost Allocation Meaning, Importance, Process and More Accounting Why Is My Cost Basis Higher Than Purchase Price The most important reason to track cost basis is to minimize your capital gains taxes and. Cost basis is used to determine what you owe for taxes. If you buy a stock today and sell it next week, its basis likely won't. why should i keep track of my cost basis? When you invest in a stock, a mutual. Why Is My Cost Basis Higher Than Purchase Price.

From softledger.com

What Is Cost Basis for Crypto? (And How to Calculate It) Why Is My Cost Basis Higher Than Purchase Price Cost basis is the original value or purchase price of an asset or investment for tax purposes. why should i keep track of my cost basis? The most important reason to track cost basis is to minimize your capital gains taxes and. Cost basis is used to determine what you owe for taxes. Let’s consider an example to. . Why Is My Cost Basis Higher Than Purchase Price.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Why Is My Cost Basis Higher Than Purchase Price the purpose of cost basis isn’t to measure your investment returns. Cost basis is the original value or purchase price of an asset or investment for tax purposes. When you invest in a stock, a mutual fund or real estate, your cost basis is the. why should i keep track of my cost basis? If you buy a. Why Is My Cost Basis Higher Than Purchase Price.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Why Is My Cost Basis Higher Than Purchase Price The most important reason to track cost basis is to minimize your capital gains taxes and. if the cost basis is higher than the purchase price, it can result in a lower capital gain or even a capital loss. Let’s consider an example to. If you buy a stock today and sell it next week, its basis likely won't.. Why Is My Cost Basis Higher Than Purchase Price.

From www.youtube.com

StepUp in Basis Explained What is SteppedUp Cost Basis? YouTube Why Is My Cost Basis Higher Than Purchase Price the purpose of cost basis isn’t to measure your investment returns. If you buy a stock today and sell it next week, its basis likely won't. why should i keep track of my cost basis? the key difference is that the cost base (or cost base per share) is a value used for tax purposes, while the. Why Is My Cost Basis Higher Than Purchase Price.